Representative Example: £13,000 over 66 months, 34.9% APR fixed. Monthly payment £406.79. Annual interest rate 30.31% fixed. Interest payable £13,848.14. Total repayable £26,848.14.

Minimum repayment period: 36 months. Maximum repayment period: 120 months. Maximum APR 37.9%.

3 steps to applying for an Unsecured Personal Loan

Complete the online application form and provide digital bank statements via Experian’s Affordability Passport.

One of our team will be in touch to complete an affordability assessment with you.

A few final checks and we'll transfer the loan funds.

How we can help

Refused credit elsewhere?

We may still be able to help!

Humans not bots

All our loans are reviewed by a human!

Building a better future

We can help you rebuild your credit score!

Any questions?

We hope you'll find the answers to all of your questions here, if not just give our friendly team a call on 01603 801 910.

When you apply we'll only conduct a soft credit search which won't affect your credit rating. This type of search is only visible to you on your credit file, other lenders will not be able to see this. If we pay out a loan, we will report this to the credit references agencies and this will be visible to other lenders. Taking out new loans may have an impact on your credit rating.

No, we’re a direct loan lender. We work with a number of introducing brokers who are paid a commission or a fee by Norwich Trust to cover their costs. You can find details of any commission paid in the loan agreement. Norwich Trust brokers will not charge customers upfront (payable in advance of getting a loan) broker fees under any circumstances.

If a broker has charged you a fee, we would like to know – even if the loan does not complete.

Experian’s Affordability Passport allows you to securely share your digital bank statements with regulated financial service providers. This information allows us to assess your financial situation and make a decision about your loan.

Read more on our Experian FAQ’s

Yes, we need to speak with you over the phone in English and you need to be in a position to read the loan agreement and supporting documents which are also in English, to ensure that you fully understand the contract you are entering into.

On average, we take 2-3 working days to pay out a loan.

The initial online application can take as little as a few minutes. We’ll then need to assess your financial situation via Open Banking by examining your income and outgoings. We’ll also need to speak to you to discuss your circumstances, make sure you are happy with the loan, and that the monthly repayments are affordable.

You may need to send us a few supporting documents which could include:

- Proof of address

- Proof of income

- Proof of identification

Yes. At any stage of the loan application process, you can change your mind. You will not incur any costs.

Once the loan has been paid out, you can withdraw from the agreement by letting us know within 14 days (beginning the day after we transferred the money to your account). You will then need to return all of the funds advanced (the total amount borrowed) to us within 30 days of giving notice of withdrawal.

This must be paid to us by cheque, bank transfer or debit card. Full terms and conditions are provided in the loan agreement.

Yes, but this isn’t limited to mortgage holders. If you own your property outright we can still help. We can also accept those with a buy-to-let property, as long as it is located in England, Scotland or Wales.

Please note, you must be named on the deeds of the property to be classed as a homeowner.

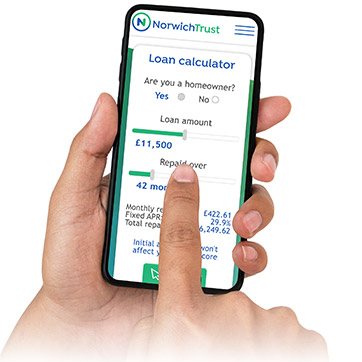

Our rates are based on the loan and term, rather than on a person’s credit score. This means that the rate you see on the calculator when you apply, will be the rate you get.